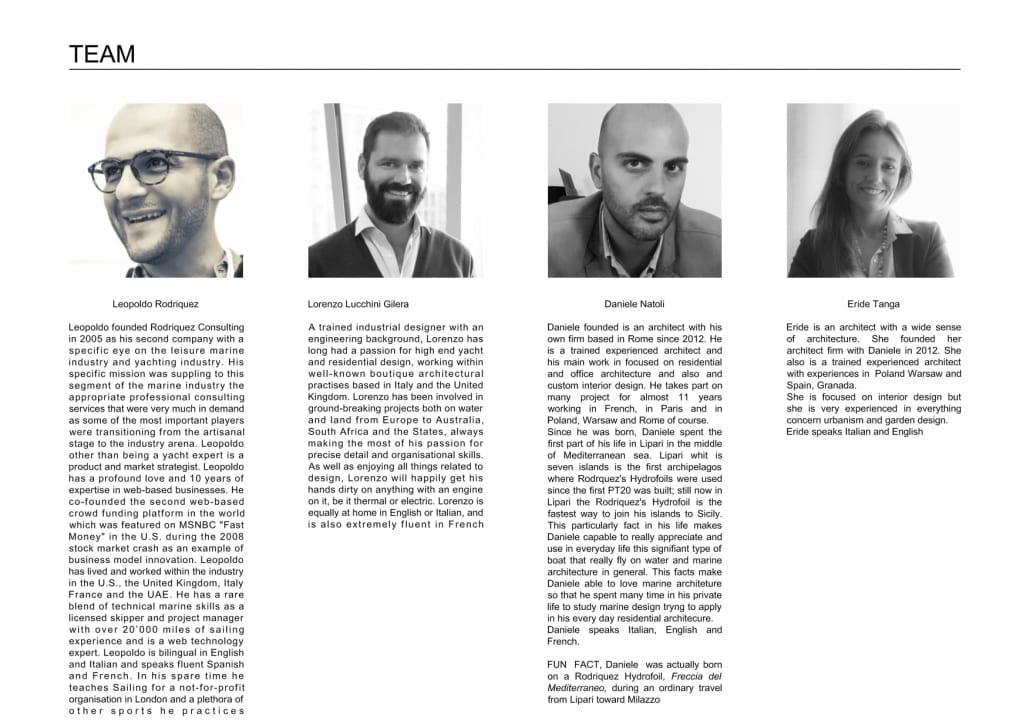

Our team has been on both buy side (pre-purchase surveyors and advisors) and sell side of numerous vessels bough and sold through auctions. Yachts and commercial vessels of various size and conditions have gone through our desk. We have been able to observe, evaluate and appreciate all the advantages and disadvantages of buying and selling through auctions. Our final conclusion, after weighting pros and cons, is that it is probably the very best way to sell or buy a vessel. Regardless, if you are a broker or professional or if you are the principal (buyer or seller). In this post we would like to give you the details and reasons why we came to such conclusion.

Why are yacht auctions great if you are a seller:

-

TIME:

Some data published by large yacht broker house suggest that over a certain size ( 30mt ) the average time to sell a yacht is 18 months from its first listing now this likely to be 50%-60% less at about 6 – 9 months for vessels between 13-25 meters but this is an even more price sensitive segment. The sale average time an auction is 1 – 1.5 months as published by YachtBid.com who in the last 5 years managed to sell 85% of the vessels auctioned.

-

THE COST OF TIME FOR ON THE SELLER

It goes without saying that yachts/vessels have running costs every month even at the dock. To simplify let’s assume 10% a year of the value of the yacht is the burning rate of the vessel X valued at 1 million euros. (without taking into account weather-induced damage that may occur when a yacht is idle and/or unattended and is not always covered by insurance) So €100k in running cost per year means that if the sale process takes 6 months the seller has an added cost of €50’000 + the risk and potential cost of weather-induced damages. This means that an offer of 950k in one month from the auction start is as valuable (if not more) than €1 million 6 months later.

-

THE COST OF TIME FOR THE BROKER (viewings):

Auctions have set viewing dates and a limited amount of time to schedule extra viewings or inspections by definition therefore the people that are interested in viewing a vessel (and eventually do a sea trial, inspection survey) have a limited amount of time to schedule it so they are forced to be decisive and efficient about it. Such process also proves how serious a buyer is about the vessel. A limited viewing and inspection time frame saves hundreds of hours and thousands of euros (especially if the vessel is far from the broker/seller) in travel costs for each individual that expresses some interest in the vessel and may also be just day-dreaming that one day he/she may buy it and truly just using the Yacht viewing as an excuse to take a holiday in some lovely yachting destination where the vessel is located.

-

PRICE AND PAYMENTS:

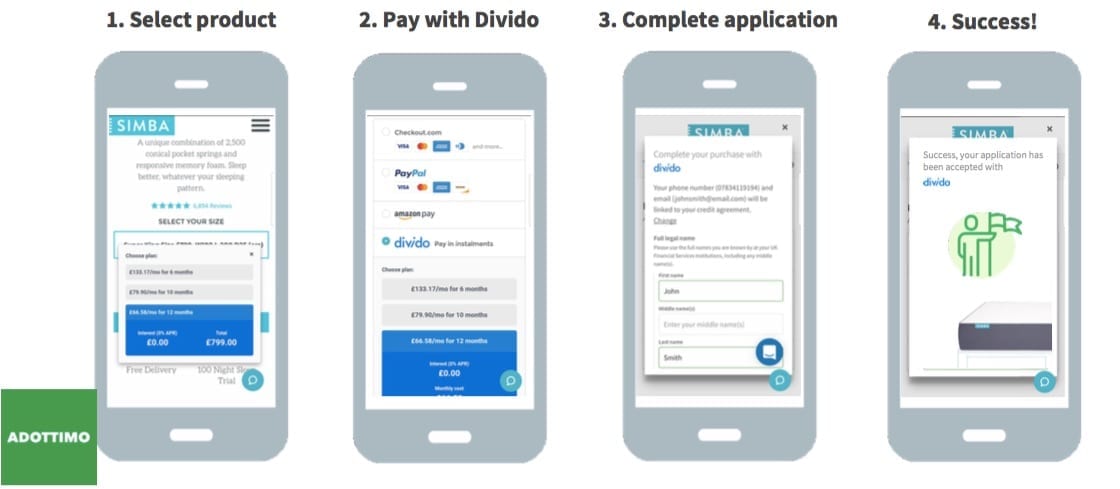

The general notion is that at auction you buy at a lower price. In most cases this may as well be true, however because of; 1) the running cost and added depreciation and decay a vessel can quickly generate costing a lot to the owner and 2) the negative effect that it can have on value to see a boat listed for sale for a year or more. At auction you may just end up getting a much more fair treatment by the market. There is also the issue of payment terms.

A lot of buyer and sellers agree on some instalments with a lump sum at the beginning. In the case of auction the buyer has to have already arranged to have the full amount. He/she will need to wire the full amount by auction end. This amount is invoiced by the auction house and received in full. The auction house acts as an escrow account. The seller at this point signs a document, whereby he/she/they take delivery of the vessel and full charge of all associated costs and liabilities. Once that is signed the auction house immediately wires the full amount to the seller, without any further hassle or delays and usually within 48hours the full amount is available in the seller bank account.

-

RESERVE PRICE AND OFFERS TOO LOW:

Auctions can run in two ways either with a low base price and a hidden reserve price above which the seller implicitly accepts the offers exceeding such reserve price or with a slightly higher base price and no reserve price at all whereby the seller reserves the right to accept or refuse the highest offer. Auctions have a setup cost just like on ebay. However, on such high ticket items it is very minor. It barely even compares to the cost of showing a boat to 15 different people in the course of 6 months even if that means fuel cost only to the boat and back.

Why are yacht auctions great if you are a buyer:

Let us tell you a real story: once we were instructed as surveyors from an English buyer to do a pre-purchase survey on a 1991 Italian-built 87 feet fly bridge yacht laying in the port of Ibiza, the asking price was €400k it had some work to do but it was sea worthy nonetheless, furthermore, it had 77 days of day charter fees to showcase for at an average price of 6,000 euros/day so the numbers showed it was quite a good deal. We conducted a full pre-purchase survey we delivered the report to the client and the client instructed us as buyer representatives to complete the transaction with the selling broker offering the full asking price to be paid in one payment only. In other words, the ideal situation for a seller.

The asking price paid in full nearly no negotiations, other than the mooring, the buyer wanted to take too. We did as instructed and we were fully paid for our surveyor services + the travel costs of course. We offered the full amount to the seller and the seller almost literally disappeared for 2 months after. So to sum-up the buyer had spent money with us + taken days to come and see the boat. He sustained the cost of sea trial. However, the buyer could not complete the sale for reasons that were completely unexpected. Later on the seller re-appeared proposing a Spanish-only vessel sale agreement. The seller wanted the full payment before signing a change of ownership commitment. Clearly that was not conceivable for an English client even if one assumes good faith.

-

BUYER HAS SAFETY OF SMOOTH TRANSACTION:

At auction the process is clear. Agreements are standardised to international legal standards. The process is explained clearly from the very beginning. There can be no surprises or changes of mind. Once the highest bidder offer has been officially accepted (within max 48 hour from auction closing). The buyer money is safely kept in escrow in a dedicated account until the buyer is signing the delivery. Once the seller has verified that the specification and pre-purchase inspection match the condition at delivery and inventory that constitutes part of the sale. The boat changes hands.

-

PRICE:

Some auctions are done because sellers wants out fast. He/she is willing to take a little less money than the market value, but faster. Some other auction require a fast sale because of a bankruptcy of a company. Some other maybe because of a divorce case, that imposes turning assets into liquidity. In some other cases boats require work. So the new owner must be someone who has the knowledge, time or simply willingness to carry on such works. In the majority of auction there is a price advantage as a buyer. The ability to act fast and buy quickly always brings a price advantage to the buyer. Furthermore, the YachtBid.com team for instance has careful consideration that the description of the vessel matches the most recent status of the vessel if a vessel is listed for sale for 9 months the pictures and videos you see may not match reality anymore so price becomes an issue of lengthy and tiring negotiations.

-

VIEWINGS AND INSPECTIONS:

At auction the buyer can simply book one of the viewing dates. Otherwise he can schedule make an appointment to view the boat. The vessel and professional personnel is ready and available to show the vessel. In private sales, without a nearby broker fully appointed with keys to the vessel. It is often difficult to schedule a viewing. Futhermore most likely the seller doesn’t have much time to use the vessel. Therefore, he/she is quite busy and hard to reach.

The value of rarity in Yacht Auction: Yachts have History with Celebrities

When it comes to yachts oftentimes they are unique and not part of production series. Some of them have the added value of some very special owners or guests in their history. For instance on YachtBid.com very recently former Frank Sinatra and Virna Lisi’s yacht was sold (see image below)

If you are the owner of a vessel interested to sell through auction contact us directly Auctions@RodriquezConsulting.com or phone +44(0)7445308622

If you are an established broker or a marine professional and you would to establish a working relationship for multiple auctions where you are the presenting broker email Malta@yachtbid.com or phone +31 (0) 20 8945579