Yacht and Marine Consultancy

For Yacht Builders, Brokers, Suppliers, Marina Developers, Institutions, Private Buyers and Investors

News and Opportunities

For Yacht Builders, Brokers, Suppliers, Marina Developers, Institutions, Private Buyers and Investors

Alternative to a Jetski? The SuperNano prototype is ready for sea trial.(VIDEO)

September 12, 2022/by Rodriquez Consulting

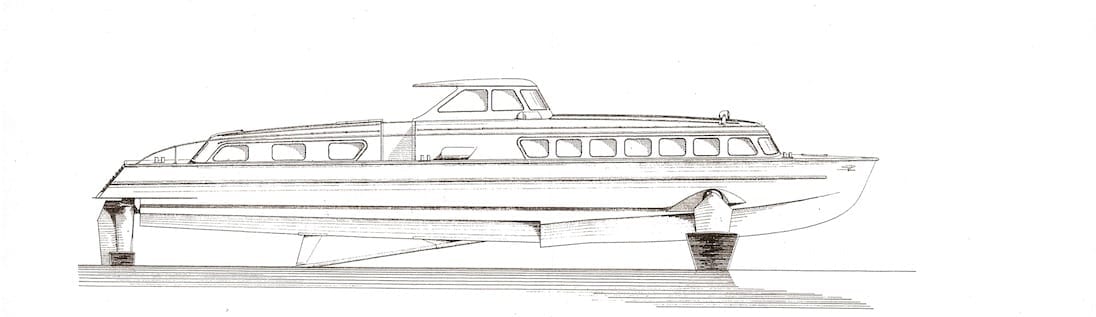

Under-construction: Alurib Tender + foils

October 3, 2017/by Rodriquez Consulting

Can Investing in Yacht Charter be profitable today? Yacht Charter Market Analysis

July 29, 2022/by Rodriquez Consulting

YACHT AUCTIONS: best way to buy and sell?

December 9, 2021/by Rodriquez Consulting

ON AUCTION NOW: Classic Yacht pre-auction 21 meters currently in charter

August 24, 2021/by Rodriquez Consulting

Proud of Our client’s Guinness World Record for the Biggest Wave ever surfed – #GoMaya

September 14, 2020/by Rodriquez Consulting

BELOW DECK: The Reality Show about Yacht Charter

August 18, 2020/by Rodriquez Consulting

UNDER OFFER -Oyster Yacht 68HP – for a quick sale

March 9, 2020/by Rodriquez Consulting

NOW SOLD!! Cranchi 50 Motor Yacht – Fully Rebuilt in 2016

July 10, 2020/by Rodriquez Consulting

REDUCED: Off-market Opportunity 40% off brand new Abacus 78 feet Flybridge Yacht for sale

June 20, 2020/by Rodriquez Consulting

The “mechanical dolphin” – Seabreacher goes on Auction starting at 25k – 75% off new price

June 15, 2020/by Rodriquez Consulting

How to enjoy your Italian summer holidays reducing the risk of Corona Virus!

March 9, 2020/by Rodriquez Consulting

Off-market exclusive Morgan Yachts 33 (ex demo boat) unregistered 50% off RRP – CONTACT US NOW –

February 28, 2020/by Rodriquez Consulting

The Yacht Charter Business Plan – Now Available for Download –

December 3, 2019/by Rodriquez Consulting

UPDATE Feb 2020: Aicon Yachts bankruptcy auction – new yachts at 50% less completed

January 6, 2020/by Rodriquez Consulting