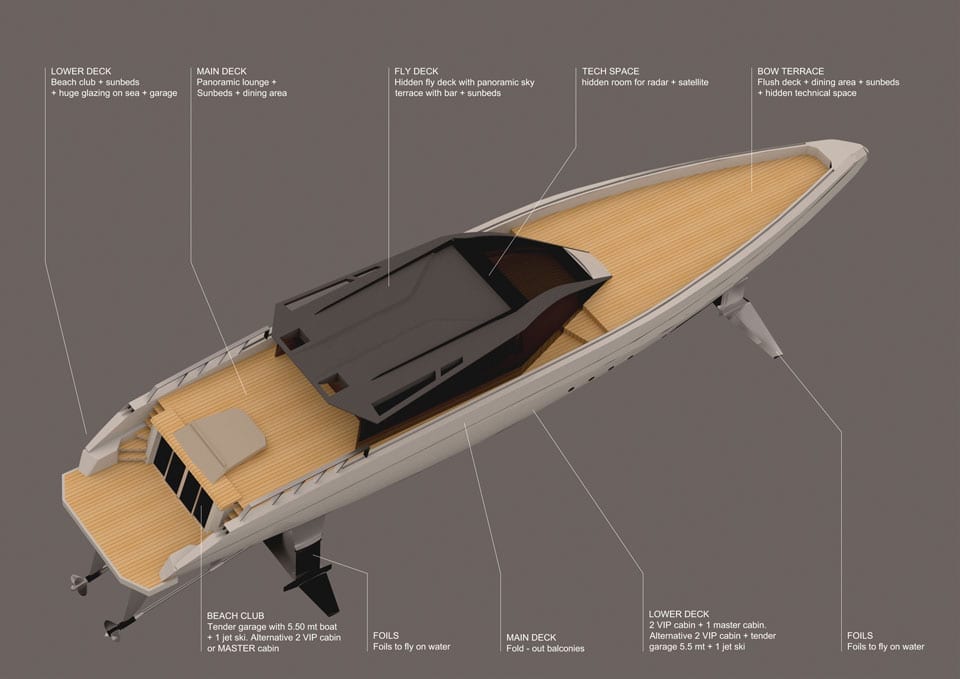

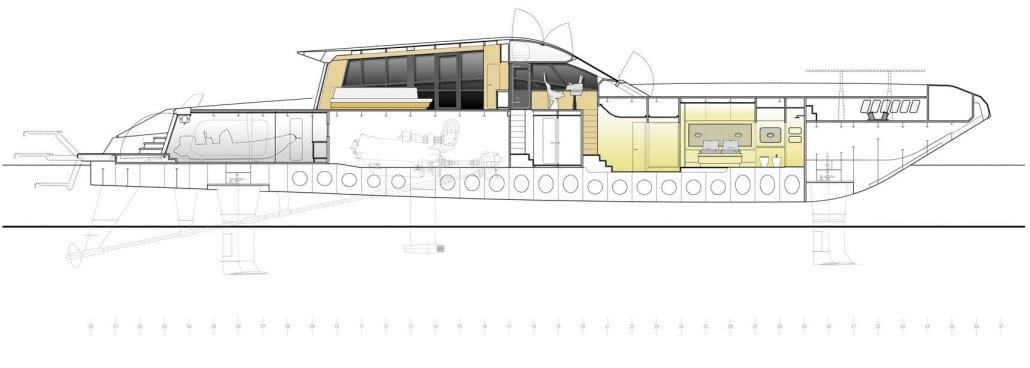

Are you looking for a valid alternative to Jetski? At first we wanted to create a flexible dinghy for our superyacht owners. However, we decided to have more fun and create something for a larger user base. Something to be safer and more user-friendly than a jetski (more stable and more user friendly). A boat you could feel the water with but also sunbathe at anchor. A boat that is easy to maintain, launch, and store in a single car garage. Lastly, we wanted to create a boat with an unusual retro/vintage feel to it on modern technology. Let’s just say it, a small watercraft to be little bit more classy than a jetski and more elegant than a 4mt rib. Ladies and gentlemen here is to you what we named The SuperNano. (www.SuperNano.boats)

It all started from an old product that we noticed in our yard that had nearly been abandoned by its owner. Now more than ever catamarans advantages are appreciated but there is not much on the market under 10 meters and without a rigging. So why not bring the fun of racing catamarans to a broader public for everybody to enjoy.

Now to the big question:

The Rodriquez team being the Rodriquez team hardly can think of a marine item without the use of foils so YES we are currently studying a foiled version but one that is truly easy to use, maintain and that is safe even for kids to operate. (We can’t disclose much more at this time but stay tuned). At this stage we can only say we will release a foiled version only when we are satisfied that is usable and relatively safe for inexperienced operators too.

1)Easier to maintain and re-power when/if needed

2)Easier to haul and lunch off the deck of a bigger vessel or off the beach, thanks to its flat bottom hulls

3)More stable at anchor, as two people can lay on the side and sunbathe

4)Safer than a jetski under way thanks to a lot more stability and less aggressive power to weight ratio

5)More loading capacity then a jetski you can easily carry your wakeboard and a case of your favourite champagne on it but also the groceries or two foldable bicycle and two electric scooters to explore your favourite islands

6) Safer for rental business to hire out and much more economical to manage.

7) Powered by outboard engines from 25hp to 60hp (one you may already own) or an electric one. (30 Mercury ELPT 4 stroke in the video reaching over 25knots)

SuperNano vs Jetski

SuperNano (Prototype) Spec Sheet:

Length 4.00m

Beam 1.72m

Draft 0.60m

Weight Approx 120 kg (without engine and options)

Height clearance 70m

SuperNano Options Available

Seats with Upholstery (color of your choice) Code #001

Any color choice for the boat (included)

Teak deck Real Teak code #002

Teak deck Synthetic code #003

Towing t-Pole for watersports code #004

Sound System #005

Bimini Top (Only Available with towing T-Pole) #006

Full Boat Cover With Your Name of Choice or boat name (embroidery) #007

Engine is NOT provided unless specifically requested installation of your choice of engine is #008

Special Steering wheel classic car style #009

If you would like to have more info book a sea-trial or would like to know about a ordering multiple units for a rental business please contact us at +44 7445 30 86 22